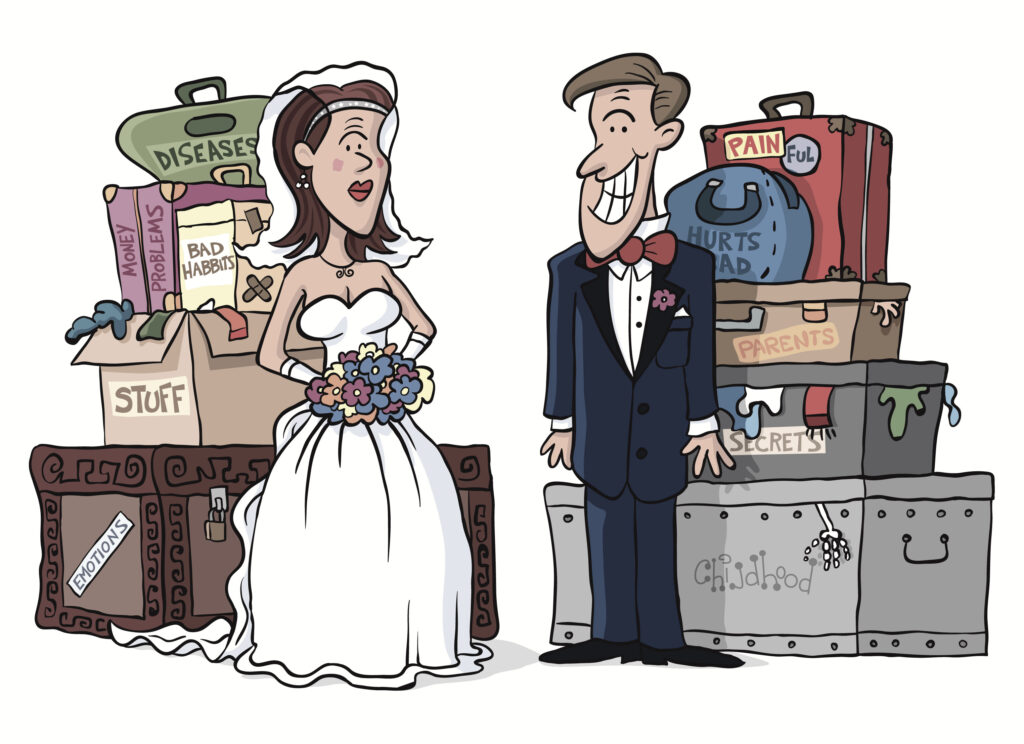

Talking about money? I must say this is an art and a bit of a science too. Talking about money in a way that is good for both my husband and I took time, patience, practice, and stick-to-it-iveness. I find in working with couples, talking about money in a way that feels good and is solutions driven is the biggest challenge as well.

WHY IS TALKING ABOUT MONEY SO HARD?

For starters, it isn’t a habit. In the pie chart of life, most couples haven’t created a slice of pie for talking about money. Money conversations usually get fit in at the end of a day, when we have the least amount of energy to connect over it or when some financial crisis or unexpected event happens. Then we scurry to talk about finding solutions to money problems.

We come from a reactive space rather than a responsive space. Over time, our nervous system gets conditioned so that talking about money is stressful, our blood pressure increases, our stomach gets tied in knots and we will avoid talking to avoid this stress.

We have to be careful to not blame or shame our partner, which ends up in a stuck conversation. Here are some tips that work for us:

TIPS FOR WOMEN WHEN COMMUNICATING WITH MEN ABOUT MONEY

- Keep emotion out of the conversation. Emotion can overwhelm your man and the focus of the meeting can get derailed.

- Instead of money meeting, think household business meeting

- Cut to the chase, make the point, move on. Here is a really great 1 minute video on the differences of how men and women process things. Women are more into details, men are not. Click HERE to view. One of my husband’s favorite phrases that tells me he is checking out of our conversation, is “TMI, which is his code for too much information.”

- Keep an agenda, stick to it, minimize tangents. While a woman’s brain likes to connect the dots (bigger corpus callosum), a man’s brain likes to stick to one topic at a time. Click HERE for a humorous video on the difference between men and women’s brains.

- Focus on the solution, not so much on processing the problem. Understand that men like to communicate to fix or problem solve.

- Feel your feelings but don’t act your feelings out on him

TIPS FOR MEN WHEN COMMUNICATING WITH WOMEN ABOUT MONEY

- Be mindful of your body language and tone of voice, women pick up energy and emotion quickly and interpret your non-verbal communication regardless of the words you are saying.

- Before you jump into fixing any problem, ask her what she needs from you. Ask her how she FEELS about what is going on. Don’t fix, solve or jump to an outcome. Just listen.

- Ask if she wants solutions before you give them.

- Understand that women communicate to “connect.” Give her space and time to connect with you. Don’t rush communication.

- Repeat back (in your own words) what you hear your partner saying. Help her to feel heard and understood by you.

- Creating space to talk about the problem first reduces stress levels in women. Give space for this, then move on to finding solutions together.

WHAT MEN + WOMEN NEED FROM EACH OTHER

- Understand your partner’s point of view rather than defending your position. Here is a communication tool when a disagreement occurs. Say to your partner, “I’m not sure I see your point of view, however, I want to better understand your thinking on this and how you think it will work.

- Consider the needs and safety of your partner equal to the consideration you give yourself.